Here's some good news if your business sends invoices to business or government customers.

Peppol* is on its way.

(That's Peppol, not Peppa.)

Ever had this conversation in your business?

You or one of your team: "Hello, I'm calling to follow up the invoice we emailed to you last month. It hasn't been paid yet."

Customer: "Really? We didn't receive that invoice?"

In addition to the time and expense of following up, the cash flow delays create stress for you and they hurt your business.

Thankfully, the adoption of Peppol will solve this problem.

What is Peppol?

Peppol is an obscure acronym for Pan-European Public Procurement On-Line. What's more important than what it stands for, is what it enables.

Peppol is an international 'eProcurement' framework for the electronic exchange of information. It creates a standard approach for governments and businesses to structure and exchange information such as invoices and other documents.

What Peppol means for you and your business

Peppol makes electronic ordering, invoicing and shipping between governments and private companies faster, simpler and more secure.

This means your business will get paid faster when dealing with government and larger businesses.

In 2019, Australia and New Zealand adopted this platform for e-invoicing which, when implemented, will make 'we never received your invoice' issues virtually impossible. The new e-invoicing system is more secure than email and provides many other benefits.

Which countries are adopting Peppol?

There are currently 40 OpenPeppol member countries: 32 countries in Europe plus Australia, New Zealand, USA, Canada, China, Japan, Mexico and Singapore.

Each country has a Peppol authority. For example, in Australia that's the Australian Tax Office (ATO).

Is Peppol already in use?

Yes it is. For example, the SuperStream system in Australia-which many businesses are currently using to automate the payment of employee superannuation contributions-is based on the Peppol protocol.

How does e-invoicing work?

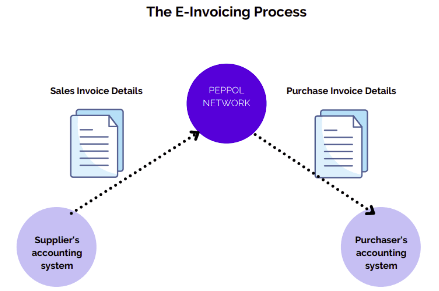

The system connects the accounting systems of all businesses and government departments via the secure Peppol network.

Suppliers generate sales invoices in their accounting systems which are sent to Peppol.

Peppol then sends the information directly into the buyers' accounting systems. This avoids:

- Non-delivery of invoices

- Data entry errors

- Processing delays

What are the cost savings?

Even though some processing at the buyer's end is still required to allocate the invoice according to the organisation's internal requirements, this automation reduces the data processing costs for the buyer.

Deloitte Access Economics calculates that every paper invoice replaced by e-invoicing will save $20. "So what?", you might be thinking?

With 1.2 billion invoices processed annually-and 89% of them still being paper-based-that represents $213.6 million in savings.

And who knew paper was still so prevalent?

Why should SMEs be excited about Peppol?

One of the common complaints by SMEs is the 30-day to 60-day payment cycle adopted by many large companies and government departments. This cash flow strain is a significant concern for many SME businesses.

From July 1, 2022, the Australian government has mandated that all Commonwealth government agencies will adopt e-invoicing.

And here's a big stick to drive adoption…

A government agency will be required to pay interest for payments made after a 5-day payment period where the supplier uses e-invoicing.

Governments encouraging big business to get on board

The Australian government is also considering further steps-such as mandatory participation-to encourage big businesses to follow their lead.

It's likely that delayed payments to suppliers by government agencies and big businesses will attract a lot of negative media attention, as 5-day prompt payment facilitated by Peppol becomes the norm.

With more and more countries adopting Peppol, any business selling internationally will also benefit from e-invoicing.

Is Peppol only relevant to B2B transactions?

Yes. E-invoicing only applies to business-to-business (B2B) transactions. It does not affect business-to-consumer (B2C) sales, locally or internationally.

Who's not excited by Peppol?

Those businesses who delay payment to your business so they can invest your money on the short-term markets, to create additional profit are not excited by Peppol. Why?

By reducing their available investment period from 45 days down to 5 days they have a lot less funds to play with.

That's a win for small and medium businesses.

But I already send invoices electronically?

Most of the major accounting software programs already allow you to email invoices to your customers, or even allow you to transmit an e-invoice directly into a customer's accounting software, if they use the same app.

It's important to understand that email is inherently insecure for data transmission. It's easily hacked or intercepted. And even though SME accounting software such as Xero allows direct Xero-to-Xero transmission of invoices, government agencies and big businesses do not use apps designed for SMEs, such as Xero.

Peppol provides a universal protocol for exchanging this information, regardless of the accounting software being used.

6 way SMEs benefit from e-invoicing

1. Efficient and accurate processing of data

Provided the data leaving the supplier's computer system is accurate, there is a high probability that the data in the buyer's system will also be accurate. Eliminating human intervention reduces the risk of error.

2. No more information 'lost in transit'

While there is no guarantee, the Peppol protocol is designed to ensure reliability of the data. If there is a delivery failure, you will know immediately and can take action to correct the error.

3. Reduced time waiting for payment

With reliable, prompt processing of sales invoices, the time between invoicing and payment can be significantly reduced which improves the supplier's-your business'-cash flow.

4. Reduced opportunity for fraud

The secure transmission of invoice information reduces the opportunity for interception or the inclusion of false invoices. Electronic matching of invoices with purchase orders will provide additional security for buyers. Of course, internal controls at the supplier and buyer end will still be critical.

5. International coverage

With 40 countries currently part of the Peppol system, the same benefits would be available on foreign transactions.

6. Accounting system agnostic

All accounting software systems will have e-invoicing capability, so there is no need to change systems.

I'm sold on Peppol. What do I do now?

The Peppol registration process is completed within your accounting software. Search for e-invoicing in the Help section of your accounting software, and you'll find the instructions. For example, here is Xero's help article on e-invoicing using Peppol.

Once your system is registered, that's pretty much all you need to do on your end. Of course, the system needs buyers and sellers to be registered..

Contact your customers to advise them that you are now registered for Peppol and encourage them to also join the network.

After all, it's a win-win to have your customers on the system.

Your next steps…

Clearly, e-invoicing is a major step forward for business efficiency. It makes sense for both buyers and sellers, of all sizes.

If you are still unsure about the process for registering or using the Peppol network for e-invoicing, get in touch on and we'll be happy to